Is Now A Good Time To Invest In An S&P 500 ETF? – Seeking Alpha

hernan4429

hernan4429

The S&P 500 has lost roughly a quarter of its value so far this year and has slipped into bear market territory. This means that ETFs that track the S&P 500, such as SPDR S&P 500 Trust ETF (NYSEARCA:SPY), iShares Core S&P 500 ETF (IVV), and Vanguard S&P 500 ETF (NYSEARCA:VOO), as well as many other index tracking ETFs, have also fallen.

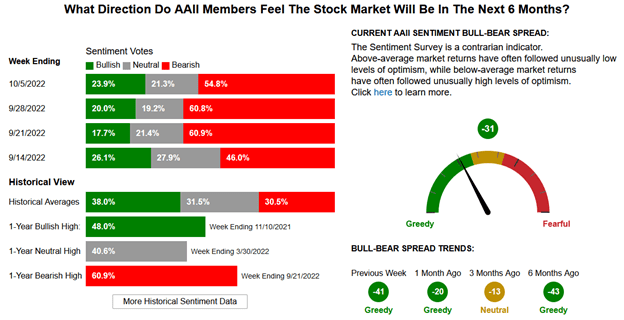

September was the worst month for equity investors since March 2020 when the Covid pandemic sent the economy into a tailspin. This means momentum is poor and volatility – as expressed by the VIX – is high. In response, investor sentiment has turned negative according to many independent organizations. The weekly survey produced by the American Association of Individual Investors, for example, is a good measure of how investors feel. The graphic below shows how pessimistic they have been in the past month versus historical averages.

AAII Investor Sentiment Survey

AAII Investor Sentiment Survey

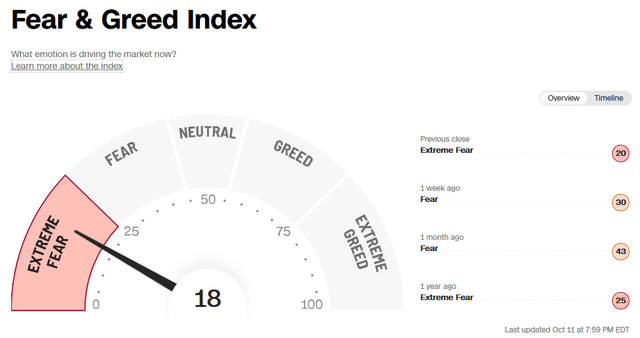

The Fear & Greed Index published on CNN also points to heightened fear among the investing public.

CNN’s Fear & Greed Index

CNN’s Fear & Greed Index

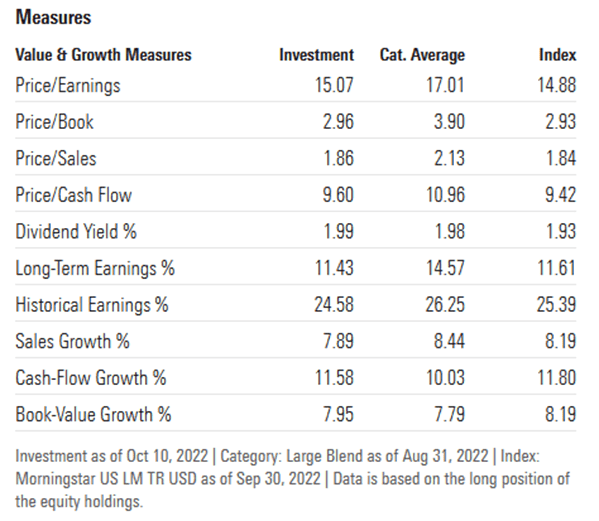

Despite the volatility and investor fretfulness, valuations are getting better, and insiders are starting to buy their own stock. The market does not look cheap, though it no longer looks expensive either. According to Morningstar, SPY’s price to earnings ratio is currently 15.07, the price to book is currently 2.96, the price to sales ratio is 1.86, the price to cash flow ratio is 9.60, and the dividend yield is 1.99%. Many of these metrics, including the PE Ratio, PS Ratio, and PB Ratio are now aligned with historic averages according to Multpl.com and Standard & Poor’s.

Morningstar’s valuation table for SPY

Morningstar’s valuation table for SPY

As most investors are selling, executives and directors are starting to buy. Websites like INK Research are a great resource to track insider trends. Each rout this year has been accompanied by a reduction in insider selling and an increase in buying. These shifts highlighted by INK Research suggest that, overall, executives and directors are more optimistic about their corporations’ prospects than the average investor. While the terms “smart” and “dumb” money get thrown around a lot and definitions for each differ for nearly everyone, one can make a strong argument that insiders represent some of the best-informed individuals out there, which should comfortably classify them as “smart” money.

To make a long story short, it is during downturns like this when long-term investors should consider deploying capital. Though picking specific stocks is a great choice for some, for others who may not have the time, expertise, or interest, picking up stakes in S&P 500 tracking ETFs like SPY, IVV, or VOO can be a great option.

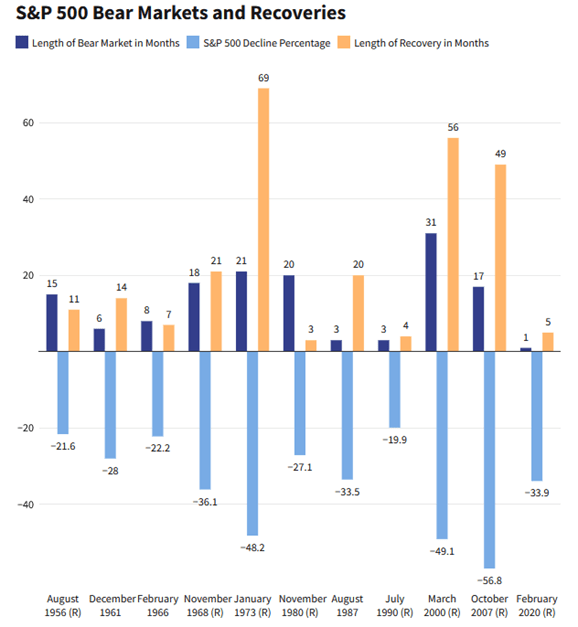

This strategy for patient investors is not to say that stock exchanges cannot continue to fall. As the graphic below by Investopedia illustrates, the benchmark may go much lower. In 2020, the S&P 500 bottomed after a -33.9% drop. In 2008 it bottomed at -56.8%, and in 2002 it dropped to -49.1%. The duration of the current bear market is still on the short side at around 10 months, and any recovery once the bottom is hit will still take time.

Investopedia

Investopedia

During market sell-offs, I resort to deploying capital regularly. I do this to balance the possibility that the index moves lower with the probability that I will not be able to time the bottom and will therefore miss out on future rallies if I wait too long. I am not a fan of dollar-cost averaging in bull markets because it guarantees buying shares during overvalued conditions, and removes the possibility of acquiring more stocks on the cheap when the next inevitable crash occurs. During downturns, however, I consistently deploy capital and start converting the cash I built up during the bull market into equities. This strategy is somewhat like dollar-cost averaging and helps me avoid the headlines, the negativity, and the paralysis that can go along with investing in a bear market.

If you were happy buying during the good ol’ times of 2020/2021 and during the initial correction here in 2022, but now have cold feet, ask yourself why. In many ways, buying into a bull market, or buying the dip but forgoing a purchase during a material decline, does not make much sense. Asset price volatility and recessions are scary, but they are short term in nature, and over the long run inflation and taxation pose a much more significant threat to wealth creation and preservation. So, if you are a long-term investor, take a big breath, remind yourself that markets are cyclical, and remember that equities tend to go up over time, which makes them a powerful remedy to the bigger threats of inflation and taxation. For me personally, this means that the lower stocks go, the more I will chip away and buy.

There are many ETFs that have significant exposure to the S&P 500. In this article, I have focused on the large, liquid, and cheap pure play ETFs, including SPDR S&P 500 Trust ETF (SPY), iShares Core S&P 500 ETF (IVV), and the Vanguard S&P 500 ETF (VOO). ETF.com is a great resource for all things ETF, and those interested in other ETFs with S&P 500 exposure can click here for a detailed list.

The S&P 500 has lost roughly a quarter of its value so far this year. ETFs tracking the S&P 500 such as SPY, IVV, and VOO have followed suit. The momentum is poor, the volatility is high, and investor sentiment is low. Despite these negatives, valuations are slowly improving and insiders have started acquiring their own stock. It is during downturns like this when plucky long-term investors should consider deploying capital. Therefore, slowly adding to stakes in equities and S&P 500 tracking ETFs, today and in the months ahead, will likely reward investors over the long run.

The opinions expressed – imperfect and often subject to change – are not intended nor should be taken as advice or guidance. The information enclosed in this article is deemed to be accurate and reliable, but is not guaranteed by the author.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.