SFDR and EU Taxonomy – Are you ready for the next steps? – Lexology

Review your content’s performance and reach.

Become your target audience’s go-to resource for today’s hottest topics.

Understand your clients’ strategies and the most pressing issues they are facing.

Keep a step ahead of your key competitors and benchmark against them.

add to folder:

Questions? Please contact [email protected]

In view of assisting financial market participants to comply with Sustainable Finance Disclosure Regulation requirements ahead of 1 January 2023, the date the regulatory technical standards enter into force, Luxembourg's Financial Sector Supervisory Authority has confirmed 31 October 2022 as the deadline for submission of the updated pre-contractual documentation for those who intend to benefit from the accelerated examination procedure.

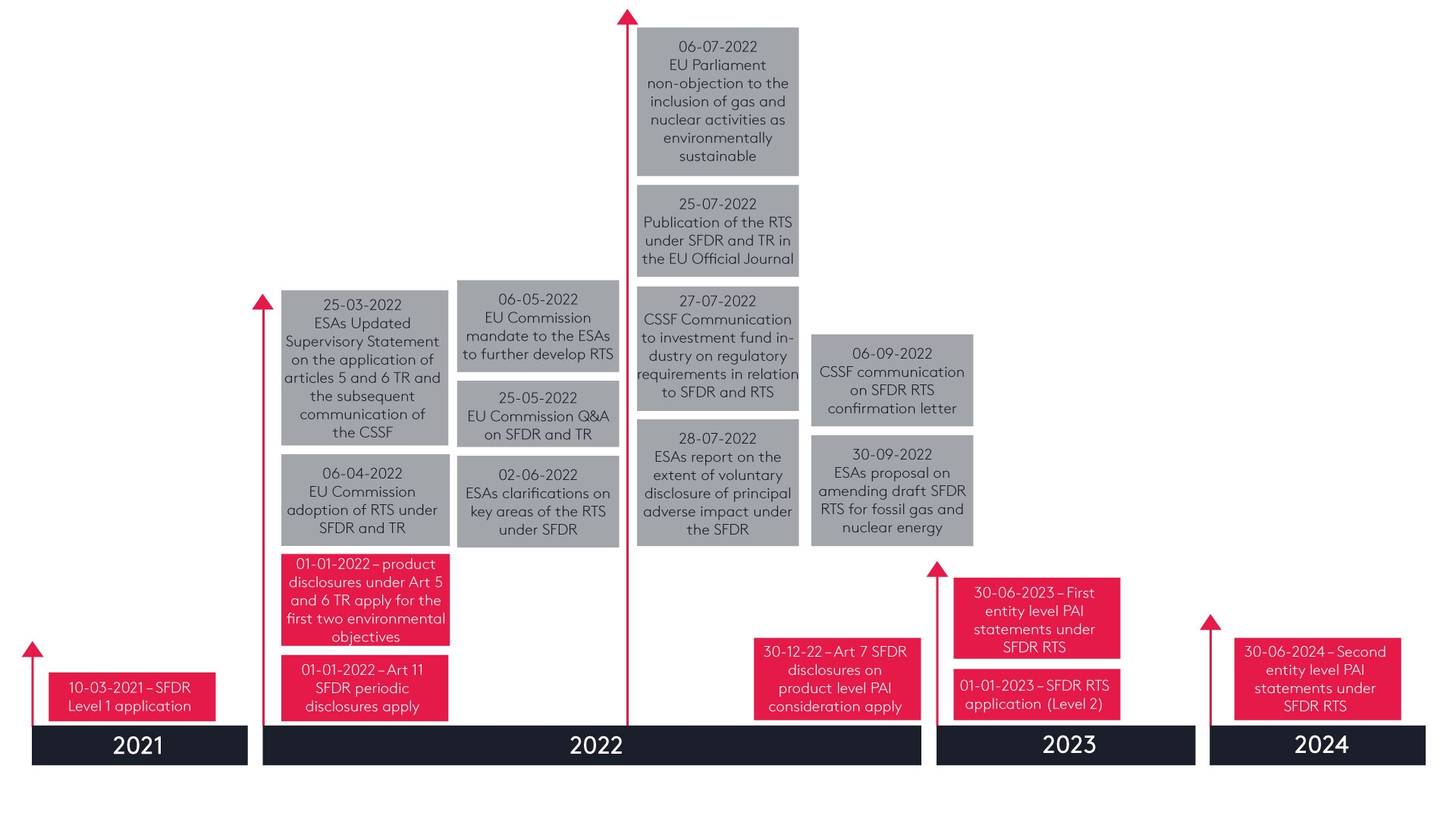

In anticipation of the long-awaited regulatory technical standards (RTS), Level 2 regulation of Sustainable Finance Disclosure Regulation (SFDR) and Taxonomy regulation (TR), both EU and Luxembourg supervisory authorities have been continuously providing guidance to market participants in order to bring additional clarity into the evolving domain of sustainability disclosures.

The European Securities and Markets Authority (ESMA) highlighted the sustainable finance roadmap as one of the key priorities in its 2023 work programme[1]. In order to remind you of the key dates and for easier navigation through regulatory events in the previous six months, we have summarised key dates and developments:

1 ESAs Updated Supervisory Statement on the application of SFDR, articles 5 and 6 of TR and the subsequent communication of the CSSF

By way of background, on 25 March 2022, the European Supervisory Authorities (the ESAs) published an Updated Supervisory Statement[2], the key objective of which was to achieve an effective and consistent application and national supervision of SFDR.

The ESAs reminded that most of the provisions on sustainability-related disclosures laid down in the SFDR were applicable from 10 March 2021. While the application of the RTS has been delayed, now confirmed for 1 January 2023, as initially foreseen in the EU Commission letter dated 25 November 2021[3].

This delay does not impact the application of the amendments introduced by TR to SFDR. Indeed, the taxonomy-alignment[4] related product disclosures are in force in respect of the first two environmental objectives from 1 January 2022[5].

The ESAs recommended using the interim period from 10 March 2021 until 1 January 2023 (the Interim Period) to prepare for the application of the forthcoming RTS, while also applying the relevant measures of SFDR and TR according to the relevant application dates.

It was also clarified that, under Articles 5 and 6 of TR, supervisory expectations for disclosures during the Interim Period are for financial market participants to provide an explicit percentage quantification to the extent of which investments underlying the financial product are taxonomy-aligned[6].

In addition, the Updated Supervisory Statement includes an annex in which the ESAs detailed the application timeline of specific provisions of SFDR, TR and the related RTS. Transitional arrangements foreseen by the ESAs for entity-level principal adverse impact (the PAI) disclosures would no longer be relevant due to the delay of application of RTS. The first PAI disclosures in accordance with RTS should therefore be made in a statement published by 30 June 2023 in respect of a reference period corresponding to the calendar year 2022.

In Luxembourg, the Financial Sector Supervisory Authority (the CSSF) issued a communiqué on 1 April 2022 in order to bring the Updated Supervisory Statement to the attention of market participants.

In line with the Updated Supervisory Statement, the CSSF encouraged the use of the draft RTS[7] as a reference during the Interim Period for the purposes of applying the provisions of articles 2a, 4, 8, 9, 10 and 11 of the SFDR and articles 5 and 6 of the TR.

2 EU Commission adoption of RTS under SFDR and TR

On 6 April 2022, the EU Commission took a further step in its action plan on financing sustainable growth by adopting the RTS[8] supplementing SFDR and TR.

In the explanatory memorandum, the Commission reiterated[9] bundling all 13 RTS into a single act, as well as deferring their application to 1 January 2023[10].

RTS brings additional precisions regarding:

Under these rules, financial market participants will have to provide detailed information about tackling and reducing any possible negative impacts that their investments may have on the environment and society. These new requirements will help to assess the sustainability performances of financial products and enhance the comparability of financial products from different sectors.

Key precisions brought by the RTS concern the following areas:

2.1 PAI reporting on the entity-level[11]

The RTS specify the content, methodology and presentation of the mandatory information required by articles 4(1) to (5) of SFDR:

2.2 Pre-contractual product disclosures

The RTSs also detail the content and presentation of the information to be disclosed at pre-contractual level in the sectoral documentation referred to in Article 6(3)[12] of the SFDR.

Financial products referred to in Articles 8(1) to (2a) and 9(1) to (4a) of the SFDR, being those which, under Article 8, promote, among other characteristics, environmental or social characteristics (the Light Green Product) and under Article 9 have sustainable investment as an objective (the Dark Green Products), must perform disclosures in that regard, using the format of templates laid down in Annexes II and III of RTS. These templates contain minimum disclosure requirements in relation to:

New requirements are developed in relation with the DNSH principle referred to in Article 2, point (17), of the SFDR. with a view of aligning SFDR's DNSH disclosures with TR minimum safeguards[13].

2.3 Website disclosures on financial products

Information that is mandatory for product website disclosures include, inter alia, descriptions of environmental or social characteristics or sustainable investment objective (as applicable) or a corresponding negative disclosure, details on investment strategies and asset allocation, monitoring data and measuring methodologies, as well as information on the attainment of the objectives.

2.4 Product-level periodic disclosures

Periodic disclosures in the sectoral documentation referred to in Article 11(2) of SFDR[14], must also be carried out in the format of the templates in Annexes IV and V of the RTS.

These templates require filling out elaborate information on, inter alia, how environmental or social characteristics or sustainable investment objectives (as applicable) were attained, historical comparisons covering up to five reference periods, and disclosures of the top 15 investments made during a particular reference period.

3 Mandate to the ESAs to further develop

One month after the RTS' adoption, ESMA published two EU Commission letters inviting ESAs to propose a set of amendments to the RTS, in line with legislative evolutions related to environmentally sustainable activities and the necessity to improve the granularity of existing disclosures.

3.1 Disclosures of product exposures to gas and nuclear activities[15]

In anticipation of the final adoption of the draft Complementary Climate Delegated Regulation[16] (see paragraph 7 below[ID1] ), the Commission requested for additional disclosures related to fossil gas and nuclear activities to be included in the RTS to ensure that market participants disclose information reflecting the provisions set out in the above Delegated Regulation shortly after the RTS application date.

The ESAs have submitted these draft RTS amendments to the Commission on 30 September 2022 (see paragraph 12 below[ID2]).

3.2 Amendments on PAI product disclosures and transparency by financial products[17]

Aside the necessity to expand disclosures in relation to the evolutions of the notion of environmentally sustainable activities, the Commission has also requested amendments to the PAI regime[18], with a view of, inter alia, potentially extending the lists of universal PAI indicators and refining all the indicators for adverse impacts and their respective definitions, applicable methodologies, metrics and presentation.

The guiding principle is reducing the risk of "false certainty" and potential "safeguards washing" by requiring well-substantiated evidence that investments align with the safeguards. It also aims at calibrating the RTS so that disclosures are proportionate and feasible for financial market participants.'

As for financial product disclosures, ESAs were requested to enhance transparency on decarbonisation targets – these should cover intermediary targets and, if applicable, actions already pursued.

Finally, a reassessment was requested on whether existing provisions of RTS regarding products referred to in Articles 5 and 6 TR sufficiently address disclosure and information on environmentally sustainable economic activities.

These amendments are expected within a period of 12 months following the receipt of the letter (by May 2023 at the latest).

4 EU Commission Q and A on SFDR and TR

On 25 May 2022, the EU Commission provided additional clarifications on the application of the SFDR and Taxonomy, following a set of queries raised by the ESAs.

Key takeaways from the Commission's Q&A document:

5 ESMA supervisory briefing on the integration of sustainability risk and disclosures

At the end of May 2022, ESMA published a supervisory briefing[21] to ensure convergence of practices of EU national competent authorities in the supervision of investment funds with sustainability features.

This briefing covers the following areas:

(a) Guidance for the supervision of fund documentation and marketing material:

(i) Creation of checklists for pre-contractual documentation assessments to ensure verification of completeness and adherence to minimum disclosure standards;

(ii) Verification of the consistency of information across the fund documentation and marketing material;

(iii) Verification of disclosure clarity and volume, absence of boilerplate language and labelling;

(iv) Principles for fund names (eg use of terms green / impact / sustainable etc);

(v) Clarifications for investment policies, which need to clearly reflect claims made in the fund documentation, as well as key disclosure elements for investment strategies.

(b) Guidance for website and periodic disclosures, respectively – alignment with the SFDR RTS and model disclosures set in its annexes.

(c) Admissibility of additional supervisory actions, which do not rely only on the financial market participants' disclosures, but on findings resulting from portfolio analyses, internal control functions, external auditors, on-site visits etc.

(d) Guidance on the integration of sustainability risks by AIFMs[22] and UCITS[23] management companies (ManCos) through risk-based, desk-based and on-site surveillance of effective implementation of relevant policies, as well as sample checks.

(e) Examples of breaches for which ESMA considers administrative measures and enforcement to be appropriate.

6 ESAs clarifications on key areas of the draft RTS under SFDR

On 2 June 2022, ESAs undertook to collate various clarifications in relation to draft RTS under SFDR which were submitted to the EU Commission on 2 February[24] and 22 October[25] 2021 respectively. Even though the EU Commission has, at the time of publication, adopted the draft Delegated Regulation on the basis of the two draft RTS, the ESAs have undertaken to share their views on the draft documents, in their versions submitted to the Commission in 2021.

Key clarifications provided by the ESAs relate to the following points:

7 European Parliament non-objection to the inclusion of gas and nuclear activities in the TR

In July 2022, the European Parliament did not oppose the inclusion of gas and nuclear activities[26], under certain conditions, in the classification of transitional activities contributing to climate change mitigation. These are now covered in the Complementary Climate Delegated Act under the TR, published in the EU Official Journal on 15 July 2022[27] and set to apply from 1 January 2023.

8 Publication of the RTS under SFDR and TR in the EU Official Journal

Following the end of the scrutiny period and the non-objection of the EU Parliament and the Council, the Delegated Regulation of 6 April was published in the EU Official Journal on 25 July 2022[28]. The date of application of technical standards contained therein has been confirmed for 1 January 2023.

9 CSSF Communication to investment fund industry on regulatory requirements in relation to SFDR and RTS

On 27 July 2022, the CSSF published a communiqué to the investment fund industry on regulatory requirements in relation to SFDR and RTS.

The CSSF reminded market participants on several key regulatory deadlines:

The CSSF also highlighted that dedicated precontractual and periodic disclosures should be submitted for each fund compartment.

It is to note that the precontractual and periodic disclosure templates must not be amended except as foreseen under Article 2 of the SFDR RTS, ie the size, font type and colour of characters.

10 ESAs report on the extent of voluntary disclosure of principal adverse impact under the SFDR

At the end of July 2022, the ESAs published the first annual report[29] to the European Commission on the extent of voluntary disclosure of PAIs under the SFDR.

This report provides an overview of examples of best practice on disclosures, as well as including a set of recommendations for national competent authorities.

In the report, the ESAs provide a preliminary, indicative and non-exhaustive overview of examples of voluntary disclosures under Article 4(1)(a) of the SFDR. The ESAs conclude that disclosures vary significantly across jurisdictions and categories of financial market participants in scope of SFDR, and it is difficult to identify definite trends.

11 CSSF communication on the SFDR RTS confirmation letter

After announcing its regulatory expectations in July, the CSSF, on 6 September 2022, made available templates for RTS confirmation letters, which are to accompany filings of updated documents. These can be downloaded from the CSSF website, by UCITS ManCos and AIFMs, for UCITS and AIFs respectively.

In order for market participants to benefit from an accelerated document examination in view of visa stamping, the CSSF reminded of several conditions which have to be met:

From a procedural perspective, the following steps will have to be followed

This accelerated procedure will only be available for documentation submitted for examination by 31 October 2022, after which the CSSF will undertake examinations on a best effort basis.

12 ESAs proposal on amending draft SFDR RTS for fossil gas and nuclear energy

Following the EU Commission mandate issued in May and the adoption of the Complementary climate Delegated Act, the ESAs have delivered their suggestions on specific disclosures to be provided in relation to investments in taxonomy-aligned gas and nuclear economic activities.

Going forward, it is proposed for financial product disclosures' templates to contain an additional yes/no question to identify the intent to invest in the above activities and if the answer is yes, a graphical representation of the proportion of investments in such activities.

add to folder:

If you would like to learn how Lexology can drive your content marketing strategy forward, please email [email protected].

© Copyright 2006 – 2022 Law Business Research