Kenya Shilling Buckles Under Pressure for 10th Consecutive Month – BNN Bloomberg

Are you looking for a stock?

Try one of these

Are you looking for a stock?

Try one of these

More

More

Latest Videos

{{ video.Name }}

The information you requested is not available at this time, please check back again soon.

Apr 1, 2022

, Bloomberg News

An attendant counts Kenyan shilling banknotes after being paid by a customer at the Euro Petroleum petrol station in the Baba Dogo suburb of Nairobi, Kenya, on Wednesday, March 28, 2018. An impending 16 percent value-added tax on gasoline in Kenya will be passed on to consumers and increase inflation, practitioners told Bloomberg Tax. Photographer: Luis Tato/Bloomberg , Bloomberg

(Bloomberg) —

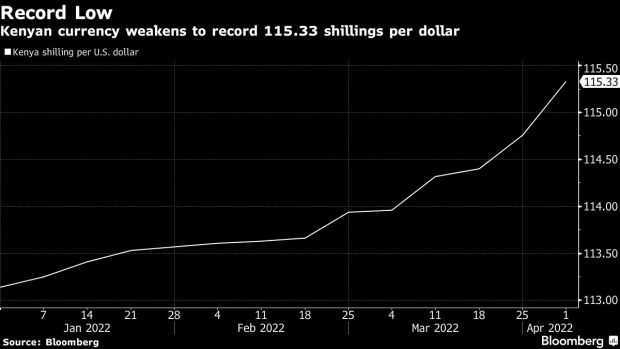

Kenya’s shilling weakened to the dollar for the 10th consecutive month in March as the dampening global economic outlook accelerated its rate of depreciation.

The currency of East Africa’s largest economy reached 115.35 per dollar on Friday, having depreciated 1% in March and 1.7% in the first quarter, according to data compiled by Bloomberg.

The global outlook has worsened in the past two months following Russia’s invasion of Ukraine, surging prices of oil and other commodities, decades high inflation in the U.S. and some countries in Europe as well as lingering concerns over the resurgence of Covid-19.

Remittances, Kenya’s largest source of foreign exchange, are expected to continue growing as the cost of sending money back home for Kenyans living in the diaspora falls, central bank Governor Patrick Njoroge said on Wednesday. Transfers jumped 22% to $338.7 million in January from a year earlier, after reaching a record $3.72 billion in 2021.

Increased dollar demand is being driven by local companies disbursing dividends to foreign investors, IC Group economist Churchill Ogutu said by phone. Safaricom Plc, Kenya’s largest company, declared an interim dividend of 25.6 billion shillings ($222.5 million) that was due for payment by the end of March.

©2022 Bloomberg L.P.

Bruce Campbell’s Top Picks: October 21, 2022

Greg Newman’s Top Picks: October 20, 2022

Alex Ruus’ Top Picks: October 19, 2022

Canadian companies are barreling toward even more pain amid an earnings season threatened by market volatility and a recession.

Retailers haven’t been forced to balance higher supply costs while keeping consumers happy in over 20 years, according to Marty Weintraub, partner at Deloitte Canada.

Canadian retail sales petered out in September after a stronger-than-expected rebound in the previous month.

Here’s a look at what analysts had to say about Interfor Corporation, Corus Entertainment Inc. and Snap Inc. .